Lucid Announces Fourth Quarter and Full Year 2022 Financial Results, Exceeds Annual Production Guidance With 3,493 Vehicles in Q4 and 7,180 in the Full Year 2022

- 3,493 vehicles produced in Q4, up 53 percent sequentially

- 7,180 vehicles produced in 2022, exceeding annual production guidance of 6,000 to 7,000 vehicles

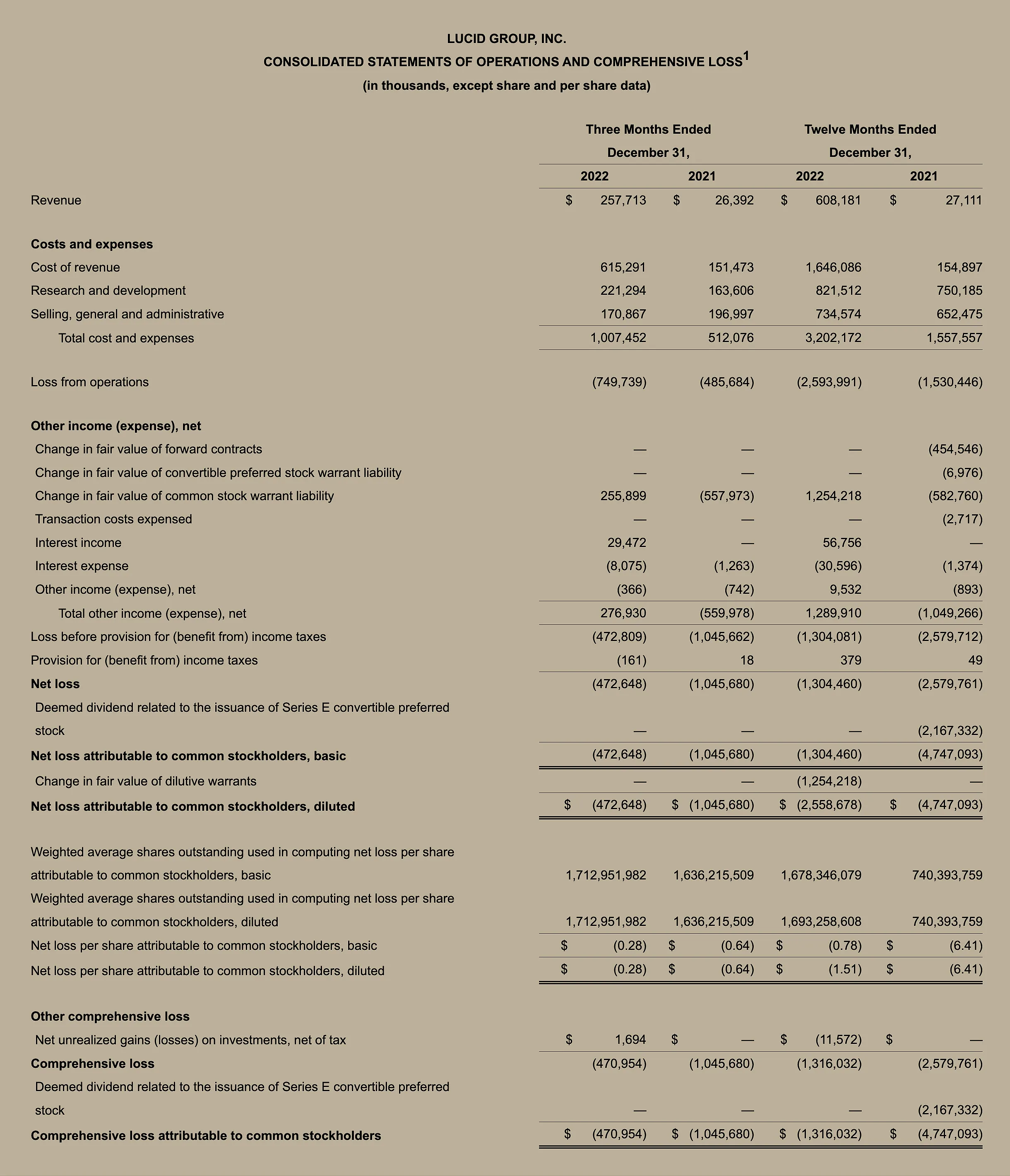

- Q4 revenue of over $257M and annual revenue of over $608M

- Ended the quarter with approximately $4.9B total liquidity

- 2023 production guidance of 10,000 to 14,000 vehicles

NEWARK, CA — February 22, 2023 — Lucid Group, Inc. (NASDAQ: LCID), setting new standards with the longest-range, fastest-charging electric car on the market, today announced financial results for its fourth quarter and full year ended December 31, 2022. The Company produced 3,493 vehicles during Q4 at its manufacturing facility in Arizona and delivered 1,932 vehicles during the same period. On a full-year basis, the Company produced 7,180 vehicles, exceeding the 2022 annual production guidance of 6,000 to 7,000 vehicles, and delivered 4,369 vehicles in 2022. Lucid today also announced its 2023 annual production guidance of 10,000 to 14,000 vehicles.

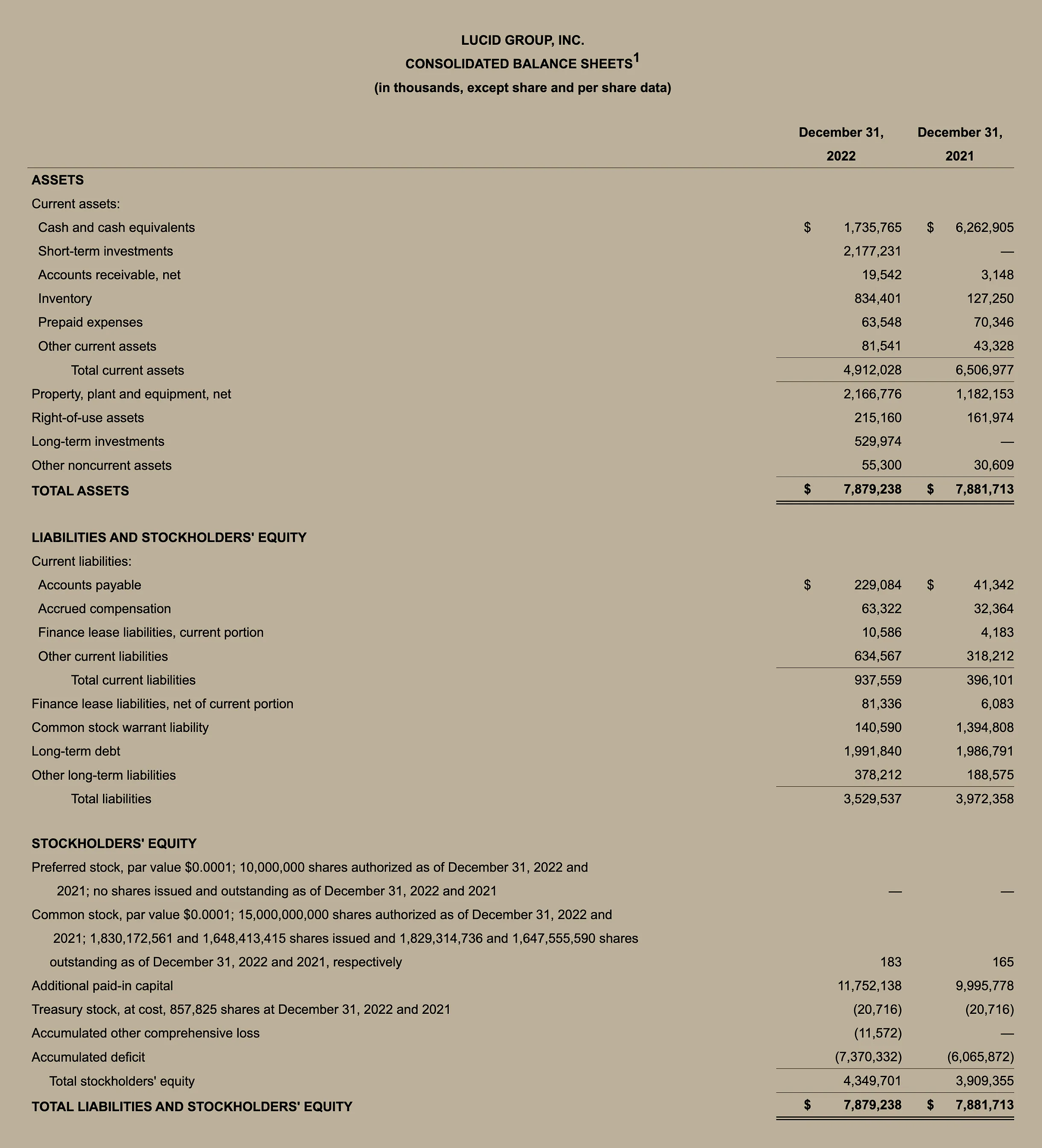

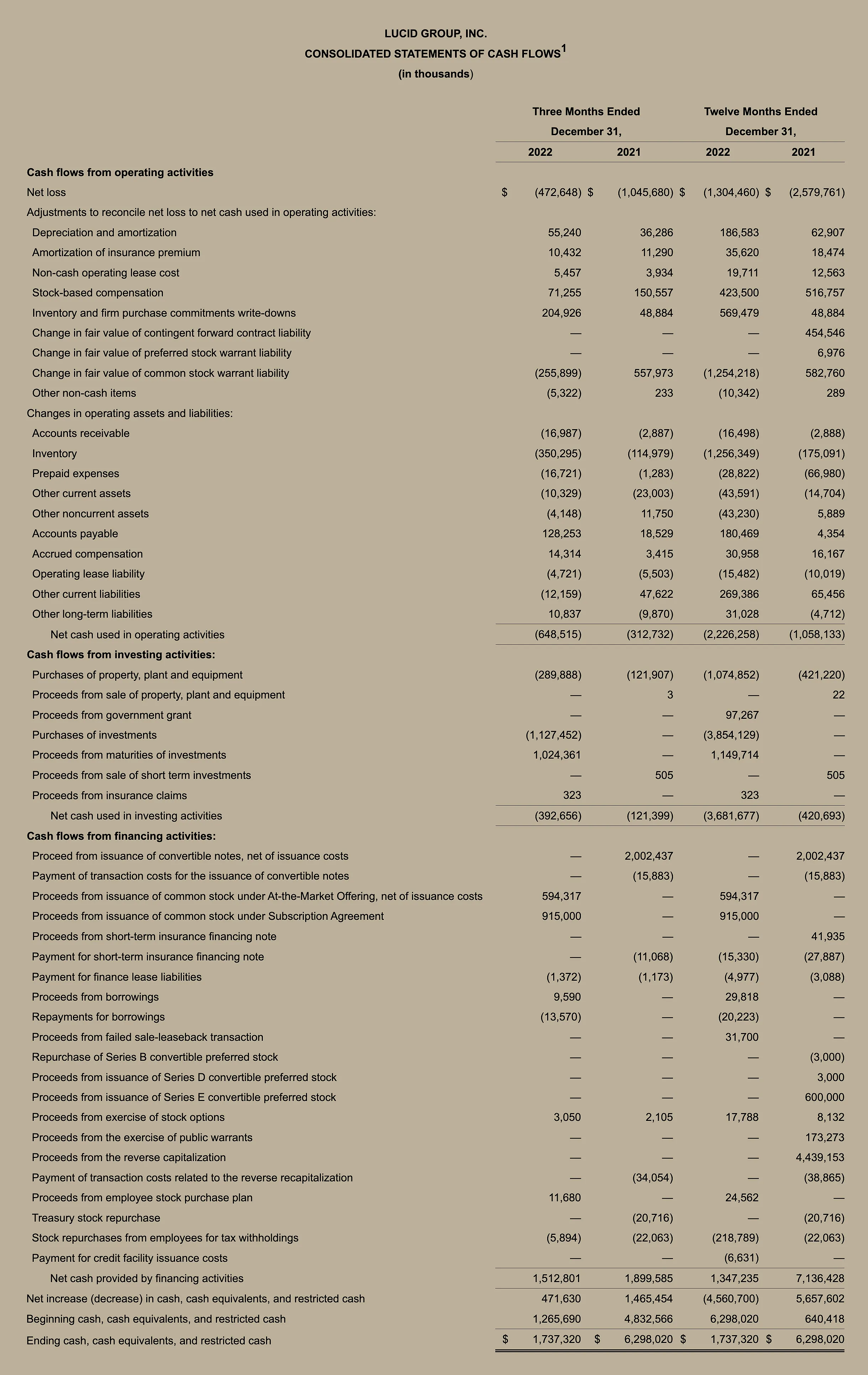

Lucid reported fourth quarter revenue of $257.7 million and annual revenue of $608.2 million, ending the quarter with approximately $4.9 billion total liquidity, which is expected to fund the Company at least into the first quarter of 2024. The Company reported reservations of over 28,000, as of February 21, 2023, representing potential sales of over $2.7 billion. This reservation number does not include the up to 100,000 vehicles under the agreement with the government of Saudi Arabia.

“Last year was a challenging year for everyone, yet despite the extraordinary supply chain and logistics challenges, the team persevered with an unrelenting focus on delivering what we believe is the best luxury sedan on the market,” said Peter Rawlinson, Lucid’s CEO and CTO.

“Lucid Air has it all — industry-leading range, exceptional driving dynamics, and superior performance all wrapped up in a truly elegant design with a spacious interior cabin. But more importantly, the technological advances of Lucid Air are developed entirely in-house with the singular goal to advance the adoption of EVs around the world for future generations to come. Lucid Air is the quintessential luxury sedan, and our goal in 2023 is to amplify our sales and marketing efforts to get this amazing product into the hands of even more customers around the world,” Rawlinson added.

“In 2022, we scaled every part of our business while keeping a sharp focus on execution. In our first full year of production, we manufactured 7,180 vehicles and delivered 4,369 vehicles, generating revenue of just over $608 million,” said Sherry House, Lucid’s CFO. “As we look ahead to 2023, we’ll continue to focus on strong capital discipline, leaving no stone unturned for every cost optimization. We are proud of our technology and product achievements. We’re gearing for growth, while simultaneously taking a comprehensive look at reducing costs, and I’m very excited about the opportunities that lie ahead of us.”

About Lucid Group

Lucid’s mission is to inspire the adoption of sustainable energy by creating advanced technologies and the most captivating luxury electric vehicles centered around the human experience. Lucid Air, is a state-of-the-art luxury sedan with a California-inspired design that features full-size interior space in a mid-size exterior footprint. Lucid Air Grand Touring features an official EPA estimated 516 miles of range or 1,050 horsepower. Produced at Lucid’s factory in Casa Grande, Arizona, deliveries of Lucid Air are currently underway to customers in the U.S., Canada, Europe and the Middle East.

Investor Relations Contact

investor@lucidmotors.com

Media Contact

media@lucidmotors.com

Trademarks

This communication contains trademarks, service marks, trade names and copyrights of Lucid Group, Inc. and its subsidiaries and other companies, which are the property of their respective owners.

Forward Looking Statements

This communication includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “shall,” “expect,” “anticipate,” “believe,” “seek,” “target,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding financial and operating outlook and guidance, amount of reservations and related potential sales, future capital expenditures and other operating expenses, ability to control costs, expectations and timing related to commercial product launches, including the Gravity SUV and the various Air models, production and delivery volumes, expectations regarding market opportunities and demand for Lucid’s products, the range and performance of Lucid’s vehicles, plans and expectations regarding Lucid’s software, product recalls, estimate of the length of time Lucid’s existing cash, cash equivalents and investments will be sufficient to fund planned operations, plans and expectations regarding its future capital raises and funding strategy, the timing of deliveries, future manufacturing capabilities and facilities, studio and service center openings, ability to mitigate supply chain and logistics risks, plans regarding the Phase 2 expansion of Lucid’s AMP-1 factory, including timing, installed capacity and potential benefits, ability to vertically integrate production processes, future sales channels and strategies, future market launches and international expansion, including plans for the European and Middle Eastern markets and the AMP-2 manufacturing facility in Saudi Arabia, the potential success of Lucid’s direct-to-consumer sales strategy and future vehicle programs, and the promise of Lucid’s technology. These statements are based on various assumptions, whether or not identified in this communication, and on the current expectations of Lucid’s management. These forward-looking statements are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from these forward-looking statements. Many actual events and circumstances are beyond the control of Lucid. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions, including a potential global economic recession or other downturn and the ongoing conflict between Russia and Ukraine; risks related to changes in overall demand for Lucid’s products and services and cancellation of reservations and orders for Lucid’s vehicles; risks related to prices and availability of commodities, Lucid’s supply chain, logistics, inventory management and quality control, and Lucid’s ability to complete the tooling of its manufacturing facilities over time and scale production of the Lucid Air and other vehicles; risks related to the uncertainty of Lucid’s projected financial information; risks related to the timing of expected business milestones and commercial product launches; risks related to the expansion of Lucid’s manufacturing facility, the construction of new manufacturing facilities and the increase of Lucid’s production capacity; Lucid’s ability to manage expenses and control costs; risks related to future market adoption of Lucid’s offerings; the effects of competition and the pace and depth of electric vehicle adoption generally on Lucid’s future business; changes in regulatory requirements, governmental incentives and fuel and energy prices; Lucid’s ability to rapidly innovate; Lucid’s ability to enter into or maintain partnerships with original equipment manufacturers, vendors and technology providers; Lucid’s ability to effectively manage its growth and recruit and retain key employees, including its chief executive officer and executive team; risks related to potential vehicle recalls; Lucid’s ability to establish and expand its brand and capture additional market share, and the risks associated with negative press or reputational harm; Lucid’s ability to effectively utilize zero emission vehicle credits and obtain and utilize certain tax and other incentives; Lucid’s ability to issue equity or equity-linked securities in the future; Lucid’s ability to pay interest and principal on its indebtedness; future changes to vehicle specifications which may impact performance, pricing and other expectations; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; and the impact of the global COVID-19 pandemic on Lucid’s supply chain, projected results of operations, financial performance or other financial metrics, or on any of the foregoing risks; and those factors discussed under the heading “Risk Factors” in Part II, Item 1A of Lucid’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2022, as well as other documents Lucid has filed or will file with the Securities and Exchange Commission. If any of these risks materialize or Lucid’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Lucid currently does not know or that Lucid currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Lucid’s expectations, plans or forecasts of future events and views as of the date of this communication. Lucid anticipates that subsequent events and developments will cause Lucid’s assessments to change. However, while Lucid may elect to update these forward-looking statements at some point in the future, Lucid specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Lucid’s assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Non-GAAP Financial Measures and Key Business Metrics

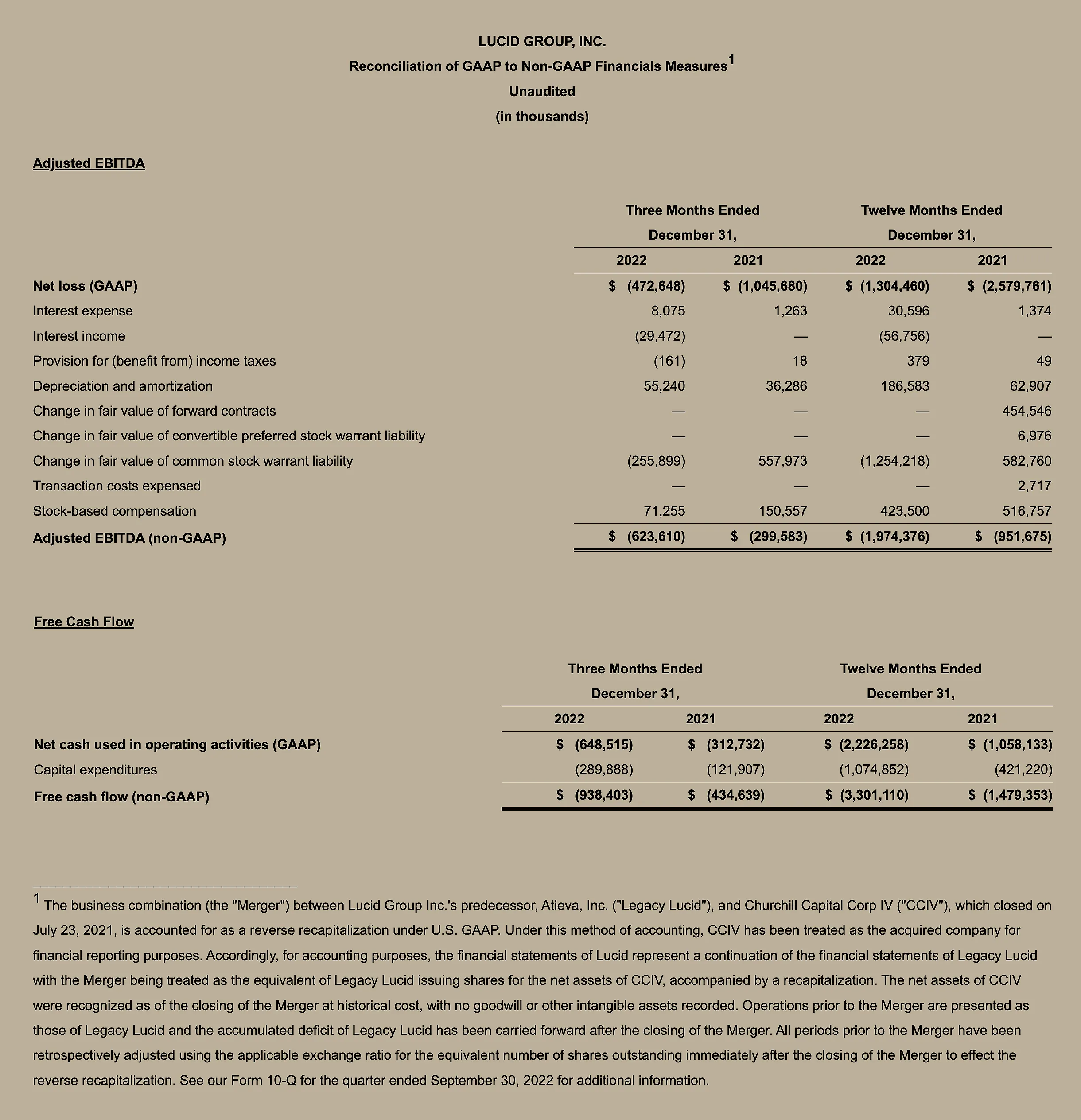

Consolidated financial information has been presented in accordance with US GAAP (“GAAP”) as well as on a non-GAAP basis to supplement our consolidated financial results. Lucid’s non-GAAP financial measures include Adjusted EBITDA and Free Cash Flow which are discussed below.

Adjusted EBITDA is defined as net loss before (1) interest expense, (2) interest income, (3) provision for (benefit from) income taxes, (4) depreciation and amortization, (5) change in fair value of forward contracts, (6) change in fair value of convertible preferred stock warrant liability, (7) change in fair value of common stock warrant liability, (8) transaction costs expensed and (9) stock-based compensation. Adjusted EBITDA is a performance measure that Lucid believes provides useful information to Lucid’s management and investors about Lucid’s profitability. Free Cash Flow is defined as net cash used in operating activities less capital expenditures. Free Cash Flow is a performance measure that Lucid believes provides useful information to Lucid’s management and investors about the amount of cash generated by the business after necessary capital expenditures.

These non-GAAP financial measures facilitate management’s internal comparisons to Lucid’s historical performance. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting, and financial planning purposes. Management also believes that presentation of the non-GAAP financial measures provides useful information to Lucid’s investors regarding measures of our financial condition and results of operations that Lucid uses to run the business and therefore allows investors to better understand Lucid’s performance. However, these non-GAAP financial and key performance measures have limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP.

Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under GAAP when understanding Lucid’s operating performance. In addition, other companies, including companies in Lucid’s industry, may calculate non-GAAP financial measures and key performance measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of Lucid’s non-GAAP financial measures and key performance measures as tools for comparison. A reconciliation between GAAP and non-GAAP financial information is presented below.