Lucid Announces Fourth Quarter and Full Year 2024 Financial Results

- Produced 3,386 vehicles in Q4 and 9,029 vehicles in 2024, in line with the 2024 annual production guidance of 9,000 vehicles

- Delivered 3,099 vehicles in Q4 and 10,241 vehicles in 2024; up 79% compared to Q4 2023 and up 71% compared to full year 2023

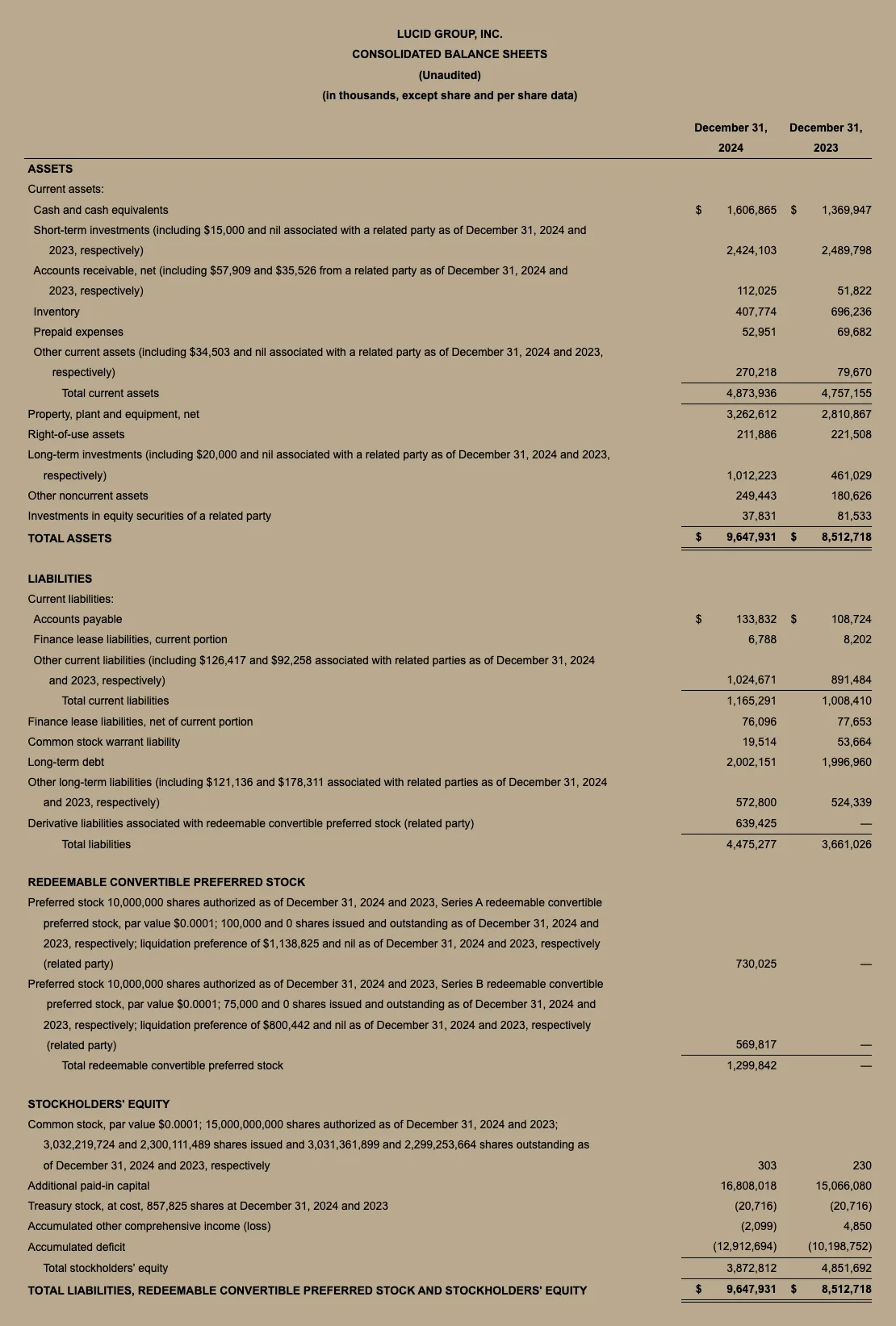

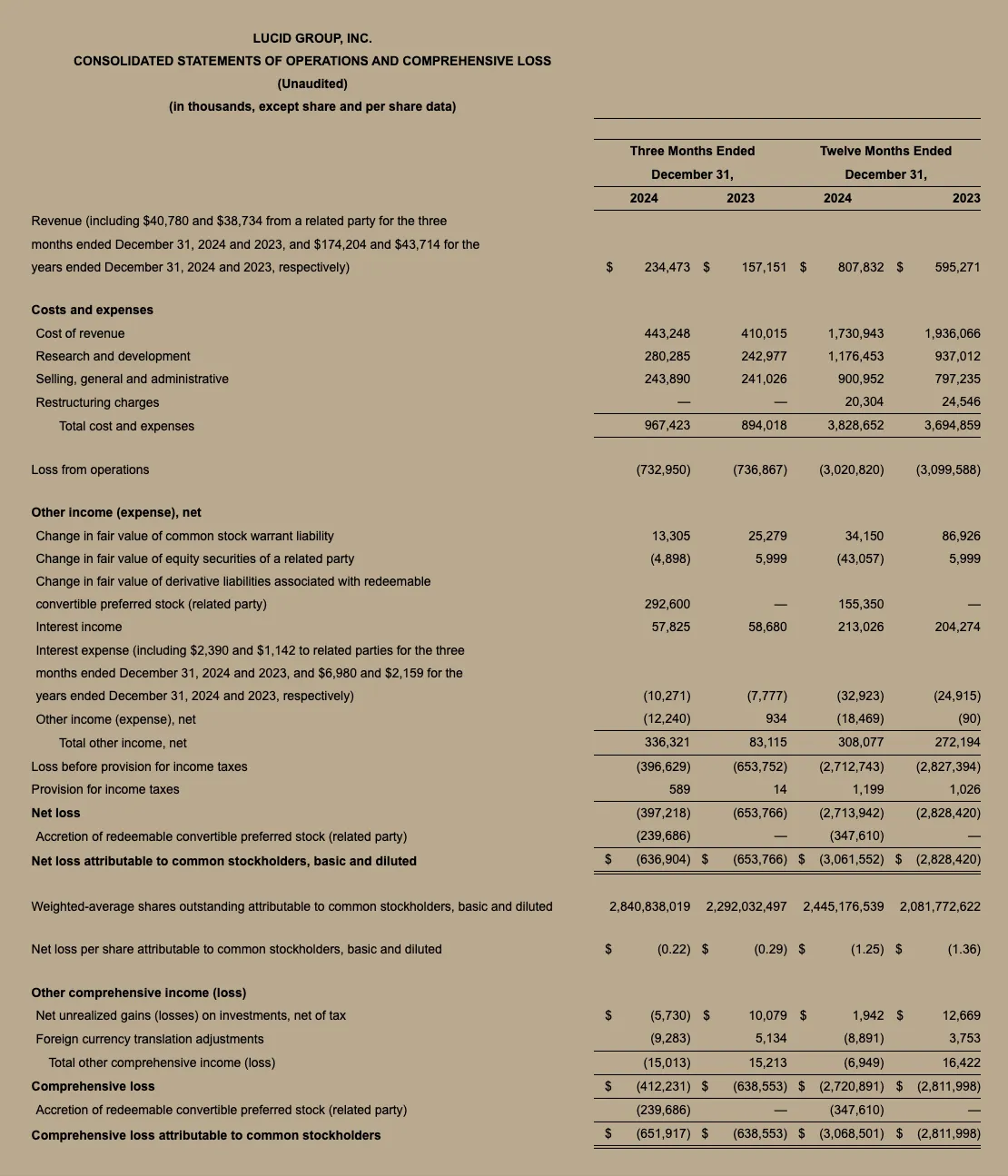

- Q4 revenue of $234.5 million and annual revenue of $807.8 million

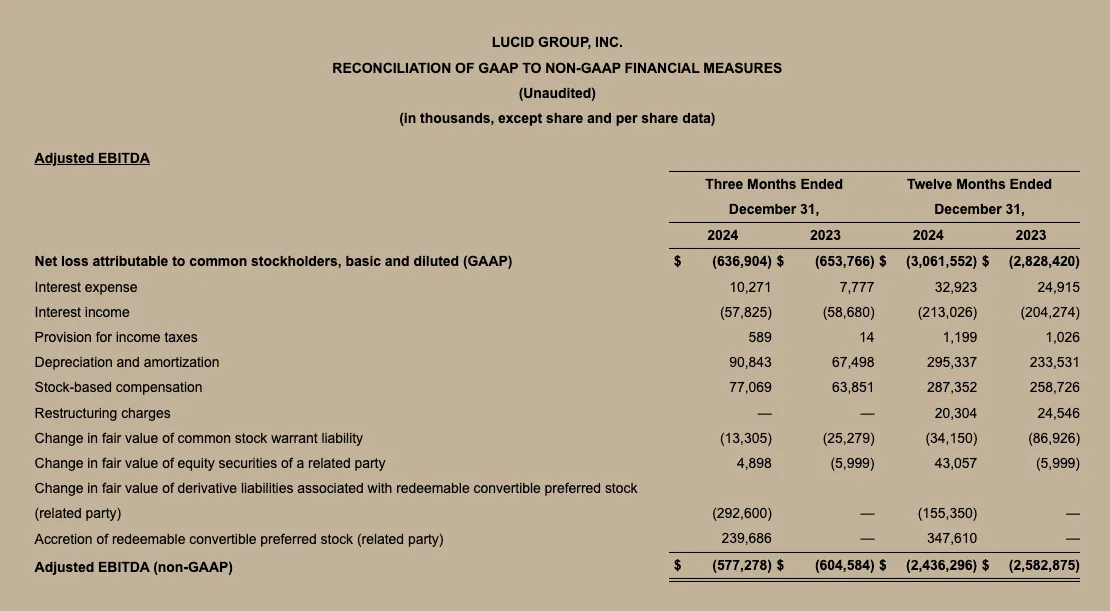

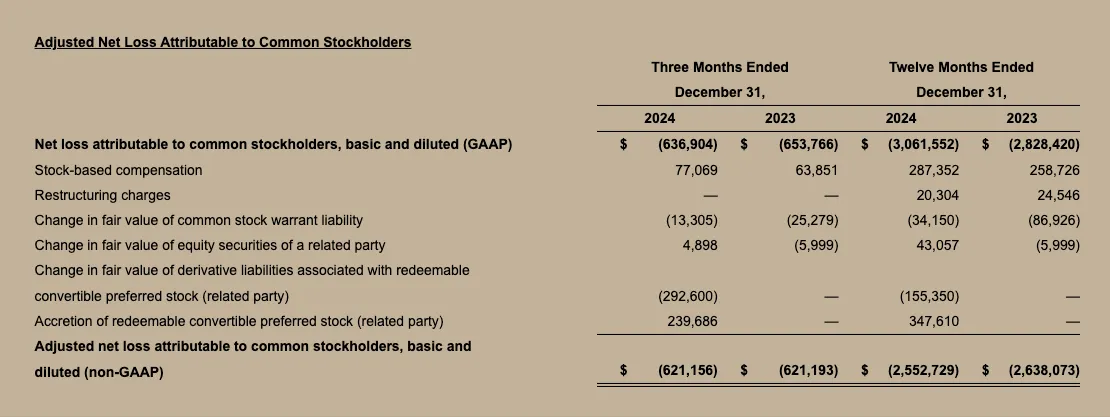

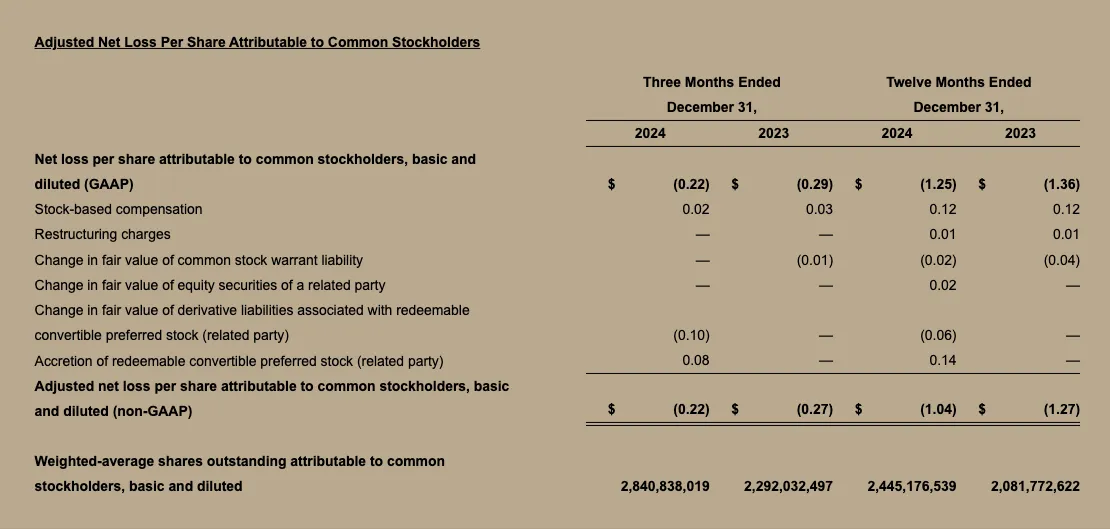

- GAAP net loss per share of $(0.22) in Q4 and $(1.25) in full year 2024; non-GAAP net loss per share of $(0.22) in Q4 and $(1.04) in full year 2024

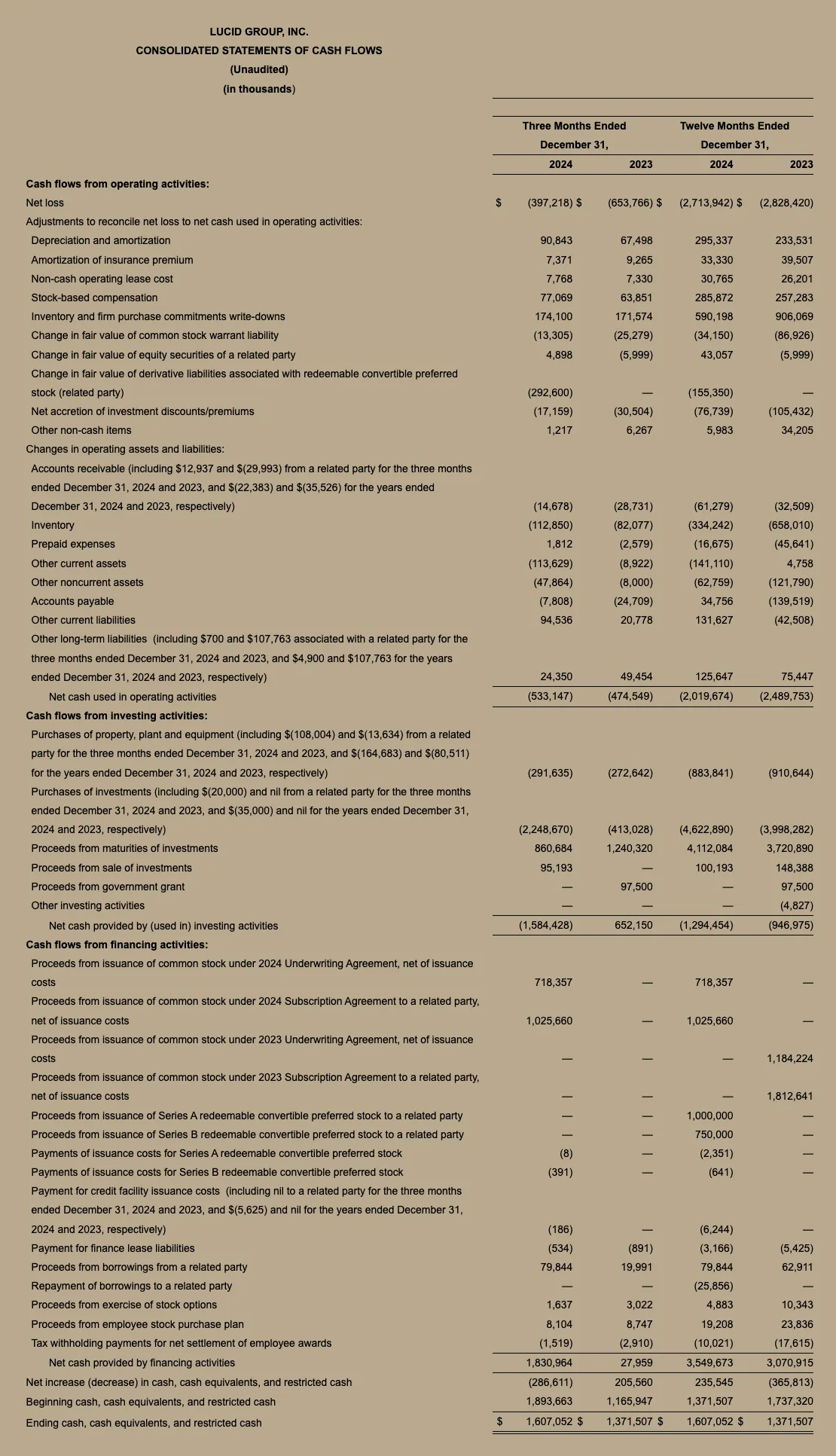

- Ended the quarter with approximately $6.13 billion in total liquidity

- 2025 production guidance of approximately 20,000 vehicles

- Announced CEO transition; Marc Winterhoff, COO, appointed Interim CEO, Peter Rawlinson to serve as Strategic Technical Advisor to the Chairman of the Board, stepping aside from his prior roles

NEWARK, CA – February 25, 2025 – Lucid Group, Inc. (NASDAQ: LCID), maker of the world’s most advanced electric vehicles, today announced financial results for its fourth quarter and full year ended December 31, 2024. The earnings presentation is available on its investor relations website.

The Company produced 3,386 vehicles during Q4 and delivered 3,099 vehicles during the same period. On a full-year basis, the Company produced 9,029 vehicles, in line with the 2024 annual production guidance of approximately 9,000 vehicles, and delivered 10,241 vehicles in 2024. Lucid today also announced its 2025 annual production guidance of approximately 20,000 vehicles, and will continue to prudently manage and adjust production to meet sales and delivery needs.

Lucid reported fourth quarter revenue of $234.5 million and annual revenue of $807.8 million, ending the quarter with approximately $6.13 billion in total liquidity.

“I am incredibly proud of the accomplishments the Lucid team have achieved together through my tenure of these past twelve years,” said Peter Rawlinson. “We grew from a tiny company with a big ambition, to a widely recognized technological world leader in sustainable mobility. It has been my honor to have led and grown this remarkable, truly world class team, because Lucid has always been first and foremost about a team effort. I look forward to continuing to serve as Strategic Technical Advisor to the Chairman of the Board and hence I am delighted to remain a part of the Lucid family to support the continued success and growth of the company.”

“2024 was a transformational year for Lucid and I am honored to step into this role as Lucid enters the next phase of its journey," said Marc Winterhoff, Interim CEO. "We have an extremely talented team that is laser-focused on ramping production of Lucid Gravity, our technology licensing business, our Midsize platform vehicles, and further monetization opportunities.”

“We saw significant momentum in 2024 with four consecutive quarters of record deliveries,” said Gagan Dhingra, Interim CFO. “Additionally, we made substantial progress in improving our gross margins, managing our operating expenses while balancing strategic growth investments, and strengthening our balance sheet with the support of the Public Investment Fund (PIF).”

Lucid will host a conference call for analysts and investors at 2:30 P.M. PT / 5:30 P.M. ET on February 25, 2025. The live webcast of the conference call will be available on the Investor Relations website at ir.lucidmotors.com. Following the completion of the call, a replay will be available on the same website. Lucid uses its ir.lucidmotors.com website as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

About Lucid Group

Lucid (NASDAQ: LCID) is a Silicon Valley-based technology company focused on creating the most advanced EVs in the world. The award-winning Lucid Air and new Lucid Gravity deliver best-in-class performance, sophisticated design, expansive interior space and unrivaled energy efficiency. Lucid assembles both vehicles in its state-of-the-art, vertically integrated factory in Arizona. Through its industry-leading technology and innovations, Lucid is advancing the state-of-the-art of EV technology for the benefit of all.

Investor Relations Contact

investor@lucidmotors.com

Media Contact

media@lucidmotors.com

Trademarks

This communication contains trademarks, service marks, trade names and copyrights of Lucid Group, Inc. and its subsidiaries and other companies, which are the property of their respective owners.

Forward Looking Statements

This communication includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “shall,” “expect,” “anticipate,” “believe,” “seek,” “target,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding results of operations, financial outlook and condition, guidance, liquidity, capital expenditures, prospects, growth, strategies, management, and the markets in which we operate, including expectations of financial and operational metrics, projections of market opportunity, market share and product sales, plans and expectations related to commercial product launches and future programs and products, including the Midsize program, plans and expectations on vehicle production and delivery timing and volumes, expectations regarding market opportunities and demand for Lucid’s products, the range, features, specifications, performance, production and delivery of Lucid’s vehicles and potential impact on markets, plans and expectations regarding Lucid’s software, technology features and capabilities, including with respect to battery and powertrain systems, plans and expectations regarding Lucid’s systems approach to the design of the vehicles, estimate of Lucid’s technology lead over competitors, estimate of the length of time Lucid’s existing cash, cash equivalents and investments will be sufficient to fund planned operations, plans and expectations regarding Lucid’s liquidity runway, future capital raises and funding strategy, plans and expectations regarding future manufacturing capabilities and facilities, studio and service center openings, sales channels and strategies, test drive, ability to mitigate supply chain and logistics risks, plans and expectations regarding expansion and construction of Lucid’s AMP-1 and AMP-2 manufacturing facilities and capabilities, including potential benefits, ability to vertically integrate production processes, future sales channels and strategies, future market launches and international expansion, Lucid’s ability to grow its brand awareness, plans and expectations regarding management transitions, the potential success of Lucid’s direct-to-consumer sales strategy and future vehicle programs, potential automotive and strategic partnerships, expectations on the technology licensing landscape, expectations on the regulatory and political environment, and the promise of Lucid’s technology. These statements are based on various assumptions, whether or not identified in this communication, and on the current expectations of Lucid’s management. These forward-looking statements are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from these forward-looking statements. Many actual events and circumstances are beyond the control of Lucid. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, economic, market, financial, political, economic and legal conditions, including changes of policies, government closures of banks and liquidity concerns at other financial institutions, imposition of tariffs and threat of a trade war, a potential global economic recession or other downturn and global conflicts or other geopolitical events; risks related to changes in overall demand for Lucid’s products and services and cancellation of orders for Lucid’s vehicles; risks related to prices and availability of commodities and materials, Lucid’s supply chain, logistics, inventory management and quality control, and Lucid’s ability to complete the tooling of its manufacturing facilities over time and scale production of Lucid’s vehicles; risks related to the uncertainty of Lucid’s projected financial information; risks related to the timing of expected business milestones and commercial product launches; risks related to the expansion of Lucid’s manufacturing facility, the construction of new manufacturing facilities and the increase of Lucid’s production capacity; Lucid’s ability to manage expenses and control costs; risks related to future market adoption of Lucid's offerings; the effects of competition and the pace and depth of electric vehicle adoption generally on Lucid’s future business; changes in regulatory requirements, policies, and governmental incentives; changes in fuel and energy prices; Lucid’s ability to rapidly innovate; Lucid’s ability to enter into or maintain partnerships with original equipment manufacturers, vendors and technology providers, including our ability to realize the anticipated benefits of our transaction with Aston Martin; Lucid’s ability to effectively manage its growth and recruit and retain key employees, including its executive team; risks related to potential vehicle recalls and buybacks; Lucid's ability to establish and expand its brand, and capture additional market share, and the risks associated with negative press or reputational harm; Lucid’s ongoing need to attract, retain, and motivate key employees, including engineering and management employees, as we have undertaken multiple significant management changes in the last few years, including our CEO; risks related to Lucid’s outstanding Convertible Preferred Stock; availability of, and Lucid’s ability to obtain and effectively utilize or obtain certain credits and other incentives; Lucid’s ability to conduct equity, equity-linked or debt financings in the future; Lucid’s ability to pay interest and principal on its indebtedness; future changes to vehicle specifications which may impact performance, features, pricing and other expectations; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; and those factors discussed under the heading “Risk Factors” in Part I, Item 1A of Lucid’s Annual Report on Form 10-K for the year ended December 31, 2024, as well as in other documents Lucid has filed or will file with the Securities and Exchange Commission. If any of these risks materialize or Lucid’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Lucid currently does not know or that Lucid currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Lucid's expectations, plans or forecasts of future events and views as of the date of this communication. Lucid anticipates that subsequent events and developments will cause Lucid's assessments to change. However, while Lucid may elect to update these forward-looking statements at some point in the future, Lucid specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Lucid's assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Non-GAAP Financial Measures and Key Business Metrics

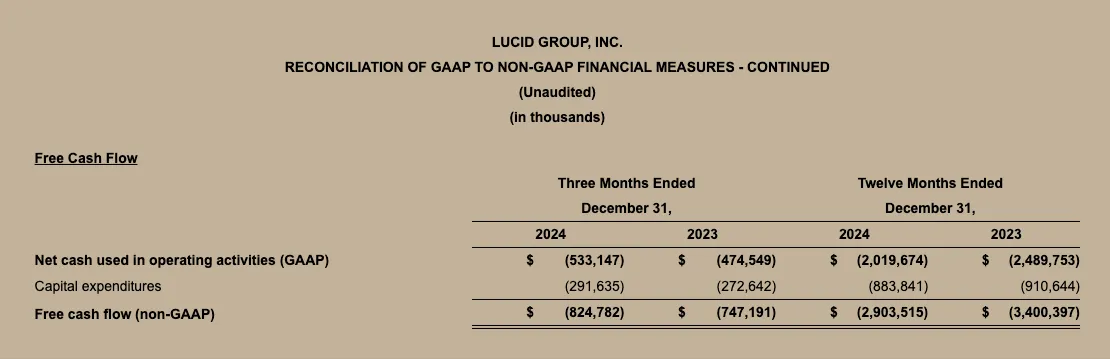

Consolidated financial information has been presented in accordance with US GAAP (“GAAP”) as well as on a non-GAAP basis to supplement our consolidated financial results. Lucid’s non-GAAP financial measures include Adjusted EBITDA, Adjusted Net Loss Attributable to Common Stockholders, Adjusted Net Loss Per Share Attributable to Common Stockholders, and Free Cash Flow, which are discussed below.

Adjusted EBITDA is defined as net loss attributable to common stockholders before (1) interest expense, (2) interest income, (3) provision for income taxes, (4) depreciation and amortization, (5) stock-based compensation, (6) restructuring charges, (7) change in fair value of common stock warrant liability, (8) change in fair value of equity securities of a related party, (9) change in fair value of derivative liabilities associated with redeemable convertible preferred stock (related party), and (10) accretion of redeemable convertible preferred stock (related party). Lucid believes that Adjusted EBITDA provides useful information to Lucid’s management and investors about Lucid’s financial performance.

Adjusted Net Loss Attributable to Common Stockholders is defined as net loss attributable to common stockholders excluding (1) stock-based compensation, (2) restructuring charges, (3) change in fair value of common stock warrant liability, (4) change in fair value of equity securities of a related party, (5) change in fair value of derivative liabilities associated with redeemable convertible preferred stock (related party), and (6) accretion of redeemable convertible preferred stock (related party).

Lucid defines and calculates Adjusted Net Loss Per Share Attributable to Common Stockholders as Adjusted Net Loss Attributable to Common Stockholders divided by weighted-average shares outstanding attributable to common stockholders.

Lucid believes that Adjusted Net Loss Attributable to Common Stockholders and Adjusted Net Loss Per Share Attributable to Common Stockholders financial measures provide investors with useful information to evaluate performance of its business excluding items not reflecting ongoing operating activities.

Free Cash Flow is defined as net cash used in operating activities less capital expenditures. Lucid believes that Free Cash Flow provides useful information to Lucid’s management and investors about the amount of cash generated by the business after necessary capital expenditures.

These non-GAAP financial measures facilitate management’s internal comparisons to Lucid's historical performance. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting, and financial planning purposes. Management also believes that presentation of the non-GAAP financial measures provides useful information to Lucid’s investors regarding measures of our financial condition and results of operations that Lucid uses to run the business and therefore allows investors to better understand Lucid's performance. However, these non-GAAP financial and key performance measures have limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP.

Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under GAAP when understanding Lucid’s operating performance. In addition, other companies, including companies in Lucid’s industry, may calculate non-GAAP financial measures and key performance measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of Lucid’s non-GAAP financial measures and key performance measures as tools for comparison. A reconciliation between GAAP and non-GAAP financial information is presented below.